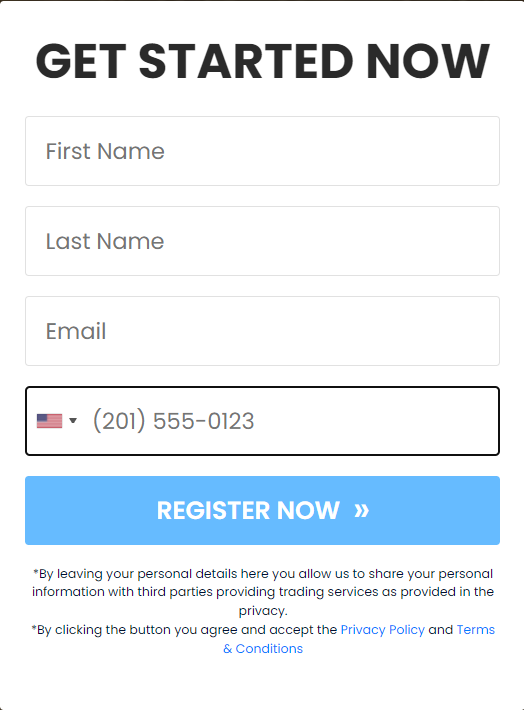

New institutional along with the inflow of retail investors into the crypto market have caused the bull market condition for various top tokens. Bitcoin and Ethereum are among them. There are some very recently established projects of DeFi such as AAVE too. Another overlooked sub-sector of the crypto market is exchange tokens. Yet their performance has been outstanding last year. This is because increases in the volume of trading caused a huge fee to get collected when the native token of the exchange is used for some settlement. Also, native exchange tokens are used typically as the base pair to fund new listings and token buyback. Click this image below to start your bitcoin journey.

The corporations of crypto have suffered additionally from the bad situation in the business of the digital assets that continues. Thus it is quite clear why the inventory worth of Coinbase dropped by more than 84 % from its all-time price high. Centralized exchange tokens retreated strongly a few months back. 3 tokens you can buy in dip are:

FTX Token

- It is without uncertainty one of the biggest crypto exchanges worldwide.

- FTX operates a worldwide model as well as a US-focussed firm.

- Blended, the 2 have been esteemed at more than $30 billion by personal purchasers.

- Thus it is extra important compared to Coinbase, having a market cap of more than $15 billion.

- This token is the main centralized exchange token worldwide.

- It has a market cap of more than $4 billion.

Its worth has fallen by 64% from its most noteworthy stage in 2021.

- With the corporate expanding to shares buying or selling, quite possibly this token will skip in the future inside the near period.

- This rebound will happen when different digital currencies start recovering.

OKB

- OKX is a major firm that provides a platform the spot people can buy and promote cryptos.

- Similar to FTX, it most spotlights on crypto derivatives.

- It has transformed into a much bigger-than-spot currency.

- By CoinMarketCap, it is capable of handling more than $10 billion of digital currencies step by step.

- OKX furthermore has choices that permit people to buy and promote NFTand various DeFi stages.

- The worth of OKB has been in a strong negative improvement beforehand a couple of months as interest in digital currencies has declined.

- Similarly, the overall amount of derivatives traded inside the ecosystem was in a descending turn of events.

- It is an effective buy because of the corporate’s general market shares.

KuCoin Token

- It is another big digital currency that handles many dollars step by step.

- Its KCS token is having a market cap of more prominent than $1.6 billion. Rather than various centralized exchange tokens, KCS has completed relatively appropriately already a couple of days.

- It has ascended by more prominent than 45% from its least stage in February.

- The most recent KCS worth catalyst was the gigantic $150 million assets that the manufacturers raised for the current month.

- They intend to utilize the assets to widen the ecosystem in regions such as DeFi and the metaverse.

Conclusion

DeFi might be ruling the discussion in the digital currency area at this moment. Yet significant issues including gas charges stay a boundary to far-reaching adoption. The carry out of layer two arrangements might offer help to this issue. Worries about liquidity across discrete blockchains keep on presenting huge obstructions to a smooth, minimal expense trading experience. Numerous people who are pursuing the DeFi publicity are unable to understand that well-known token listings along with lower fees of trading have prompted a resurgence in the centralized exchanges’ use. This converts into a bigger client base. It manages more transactions, prompting an expansion in volumes of trading and a healthy appreciation of price for hidden exchange tokens such as KCS, BNB, and FTT. Centralized exchanges are still seen to capture the trading volume majority. This will not change soon. Decentralized exchanges such as Uniswap have begun to grow in prominence and take part in the centralized exchanges’ market share. They will be comprised of only a little portion of the total volume of trading seen in the market of crypto. The battle among exchanges will be there. Thus exchange tokens’ increased inflow may cause future upside. Centralized exchange tokens are capable of boosting governance and huge yields allure fresh inflows and CeFi started merging with DeFi.

More Stories

Comparative Analysis of Digital Gold and Silver: Bitcoin and Litecoin

Bitcoin Deep Dive: Exploring the World of Digital Wealth

Creating a Winning Oil Trading Mindset